| Solar + Powerwall Residential Federal Investment Tax Credit | Standalone Powerwall Residential Federal Investment Tax Credit | For Systems Receiving Permission to Operate in |

|---|---|---|

| 26% | 0% | 2021 |

| 30% | 0% | 2022 |

| 30% | 30% | 2023-2032 |

| 26% | 26% | 2033 |

| 22% | 22% | 2034 |

| 0% | 0% | 2035 |

Switching to renewable energy isn’t just great for the environment—it’s also a smart financial move. Many state and local governments offer energy credits, rebates, and incentives to encourage homeowners and businesses to invest in solar power, EV chargers, and energy-efficient upgrades. These programs help offset installation costs and accelerate the return on investment.

At Rush Hour Engineering, we stay up to date with the latest incentive programs available in your area. Our team will guide you through the application process, ensuring you take full advantage of available tax credits, grants, and utility rebates.

Let us help you unlock these savings and make your transition to clean energy even more affordable. Contact us today to learn more about available energy credits in your area!

Solar systems produce electricity to power your home but often produce extra energy

that can be stored in your home battery backup or sold to utility companies through the power grid.

When excess solar power is sent to the grid, you earn energy credits from the power company to offset your future usage.

At the end of the year, any remaining credits are paid out to you by the electric company. That’s right, you can get paid to go solar!

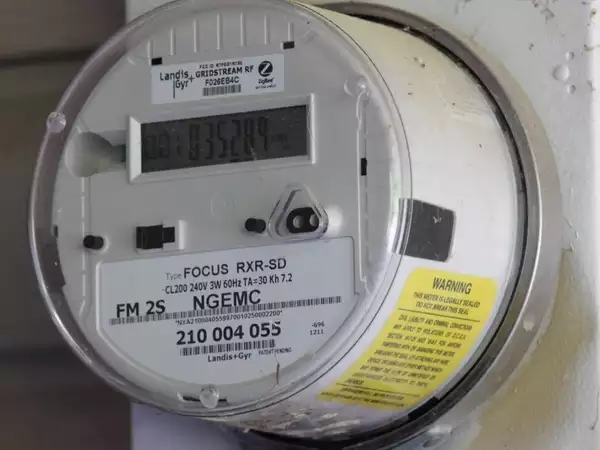

All Investor Owned Utilities (IOUs) in the Sunshine State must abide by Florida’s net energy metering law. Luckily, the IOUs provide most of the state’s residential power. You can apply for the program with your local energy provider to ensure your home system is compatible with Net Metering. Once approved, you’ll get a new energy meter that measures the excess power you send back to the grid. Individual net metering provider details are linked below!

– Florida Power & Light (FPL)

This includes Gulf Power Company which was fully integrated with FPL on 1/1/2022

– Duke Energy (Florida)

– Tampa Electric Company (TECO)

– Florida Public Utilities Company (FPUC)

Upgrading your property with renewable energy solutions is more than just an eco-friendly decision—it’s a smart investment that enhances its market value. Installing solar panels, Tesla Powerwalls, and EV charging stations makes your home or business more attractive to buyers and tenants who prioritize energy efficiency and sustainability.

At Rush Hour Engineering, we provide expert installation of solar panels, energy storage solutions, and EV charging stations to help you maximize your property’s value while embracing a sustainable future. Contact us today to learn more about our innovative energy solutions.

At Rush Hour Engineering, we specialize in providing cutting-edge Engineering, Procurement, and Construction (EPC) services for residential and commercial projects.

Copyright © 2025, RUSH HOUR ENGINEERING. All Rights Reserved.